Japan's economic vulnerabilities

The American financier Jim Rogers asserts that the worst economic downturn since the Great Depression will happen in 2020. Japan in particular will be hit hard because of its high national debt, low birth rates and virtual ban on immigration.https://www.japantimes.co.jp/news/2019/02/20/business/american-investor-jim-rogers-warns-severe-economic-downturn-forecasts-grim-future-japan/

In particular, the world has loaded up on debt, and debt is a time bomb.

In the book, he foresees a catastrophic economic downturn within a year or two due to the “unprecedented” level of debt worldwide. The Institute of International Finance reported that global debt soared to $247 trillion in the first quarter of 2018, and Rogers said debt has increased by $75 trillion, or 43 percent, since 2008.Debt to GDP of the most populous nations in the world:

https://www.mercatus.org/sites/default/files/CHART-large.jpg

The "replacement rate" for fertility -- at which a population exactly replaces itself from one generation to the next -- is 2.1 children per family. The fertility rate in Japan is almost half of that.

https://apjjf.org/data/fig2.jpg

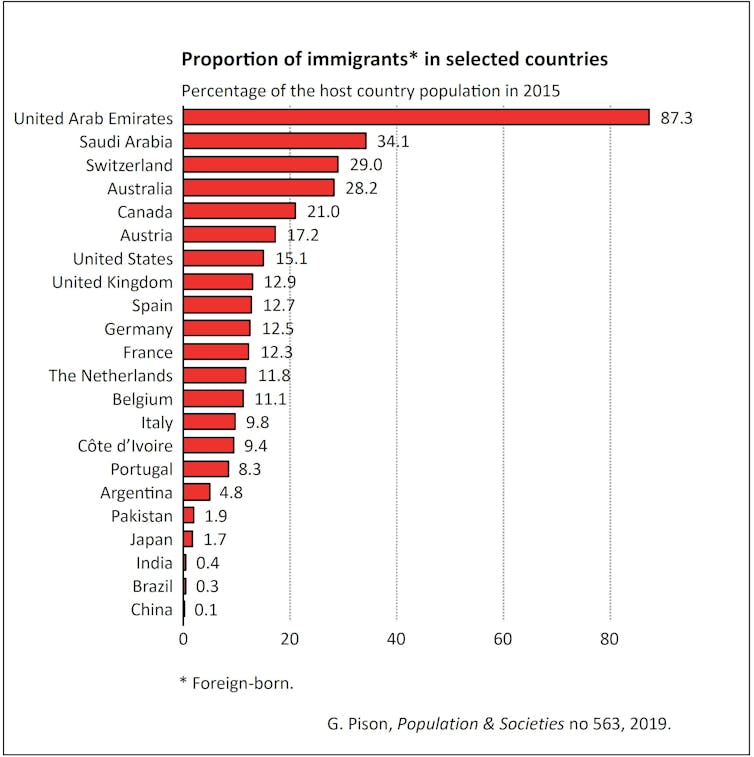

The immigration rate in Australia is an astonishing 28 percent. Australia has not had a recession in 27 years because immigrants provide both a workforce and demand for goods and services. (The sore point of high immigration rates is higher housing prices and a fear of immigrants, especially Muslims.)

https://www.nytimes.com/2019/04/22/world/australia/immigration.html

By contrast, the immigration rate in Japan is a paltry 1.7 percent.

https://images.theconversation.com/files/264378/original/file-20190318-28468-em1hkc.jpg

"White swan" threats and collective amnesia

A black swan event is a catastrophe that nobody foresaw -- although after the event all sorts of "experts" chime on how it was obviously going to happen for whatever reasons.https://en.wikipedia.org/wiki/Black_swan_theory

The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. The term is based on an ancient saying that presumed black swans did not exist – a saying that became reinterpreted to teach a different lesson after black swans were discovered in the wild.A classic black swan event might be the bubonic plague that afflicted Europe in the mid-14th century. No one expected it then, although in retrospect, classic conditions existed for the Black Death to sweep through Europe:

- globalization (the plague originated in Mongolia and spread with the Mongol conquest);

- overpopulation in Europe (especially with dense cities and with people living near animals, either on farms or next to the wilderness); and

- economic crisis caused by climate change.

A white swan threat might remind us of the saying "Fool me once, shame on you; fool me twice, shame on me." Something unexpected and totally unpredictable once happened, and now we should know better. But people forget.

Interestingly, the conditions for the transmission of the plague that existed in the 14th century are widely expected to exist throughout the 21st century. Yet there is little discussion about or preparation for the possibility of a pandemic that might kill half the world's population within our lifetime. It would appear that white swan threats can induce collective amnesia.

Is the potential for Japan's collapse in 2020 also a white swan threat that is being overlooked? After all, Jim Rogers is not a fringe conspiracy theorist or a perpetually gloomy economist with a weird foreign name (Nouriel Roubini). Jim Rogers seems to be a totally positive and friendly American guy doing conventional, plain vanilla economic forecasting.

Jim Rogers' advice to Japan to allow more immigration does not seem to be gaining traction. Jim Rogers does give some advice to young Japanese to deal with their reduced prospects.

In 2017, he said on a financial podcast that “if I were a 10-year-old Japanese, I’d get myself an AK-47 or I’d leave” because of the country’s harrowing economic prospects.What is Jim Rogers' advice for the rest of the world in terms of dealing with the impending economic and political collapse of Japan? Should we also buy AK-47s? How would a long economic depression change politics in Japan? The world has been afflicted by a wave of populism, nationalism and authoritarianism, yet after 30 years of stagnation, Japan has not succumbed to even a trace of anything like that. The reason for that might be that for almost 75 years in Japan, the conservative Liberal Democratic Party has had a monopoly on power and has institutionalized an elitist form of nationalism and authoritarianism. In the face of economic collapse, that ingrained ultra-conservatism might either prevent or promote the rise of fascism in Japan.

Nassim Taleb might offer some useful advice. Because we cannot predict a black swan event, Taleb argues that the best policy is to reduce vulnerability in general to prepare for potential unexpected catastrophes. For example, a low debt level is advisable because debt blows up in a crisis.

To prepare for a white swan event like the collapse of Japan, it might be imperative to reduce dependency on Japan. South Korea might have an inadvertent head start limiting its dependency on Japan. Because the two countries are now in a trade dispute, South Korea has been forced to consider alternative suppliers for its tech industry.

Two practical questions are suggested by the case of Japan's economic vulnerability:

In particular, How to reduce dependence on Japan?

More generally, as individuals and as a society, How can we reduce vulnerability?

Perhaps one of the greatest white swan threat today is the possibility of a oil price spike that could disrupt the world economy. The rise of oil prices to $147 per barrel in 2008 was a classic black swan event.

https://en.wikipedia.org/wiki/2000s_energy_crisis

https://www.wsj.com/articles/saudi-oil-attack-this-is-the-big-one-11568480576?mod=rsswn